สาระน่ารู้

How to make business profit 26 May 2020

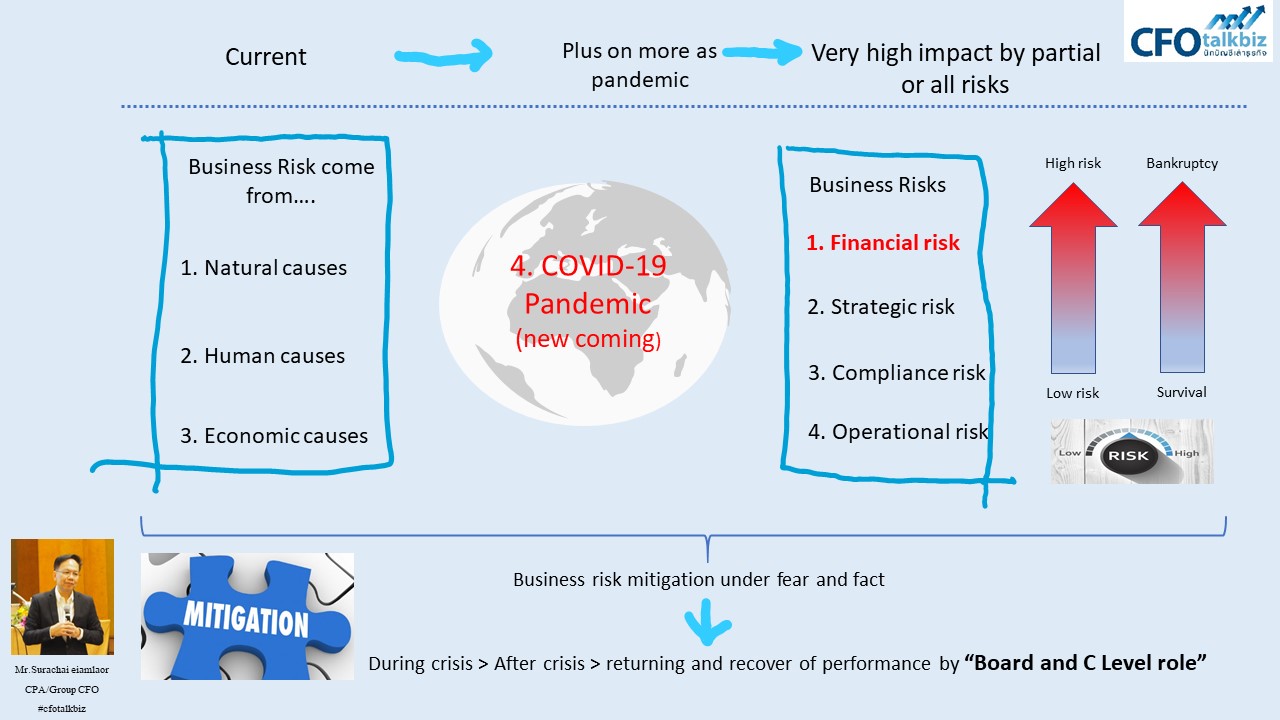

2020 Business risk causes, Business liquidity, and future business plans

2020 Business risk causes, Business liquidity, and future business plans

Every crisis in the past of my business experience of liquidity controlling those impact was not so severe to business risks and not a long time in the world, such as COVID-19.

In my opinion, I would like to add that pandemic is the 4th cause of business risk.

Today, various businesses can assess the impact of COVID to a certain extent.

Re-opening entities – my idea must do a stress test of net cash flow for flexible strategy

1. Negative: operating income status, market share, and liquidity those not the same by getting worse. Must consider a new business plan, adjust vision to be flexible, how many months does the business running? make a defensive plan, plan out of business, see my picture

2. Positive: net cash flow as still have positive status from operating income and more liquidity. You shall implement an aggressive strategy, investment, expand the business, add new business and acquisition or a merger with the company’s liquidity problems

Lock-down entities – my idea must do a stress test of net cash flow for flexible strategy in a worst-case scenario

1. Set the business opening date, a stress test of cash inflow vs cash outflow that included next normal situation investment

2. Still, lock-down 12 months that no cash inflow that how business running and ensure financial supporting? Can solving or Out of business

Surachai Eiamlaor CPA/CFO

cfotalkbiz@gmail.com

cfotalkbiz@gmail.com

081-839-6592

081-839-6592  sdgc

sdgc